Contributor: Leo Kivijarv, Ph.D., Executive Vice President & Director of Research of PQ Media

In August 2019, PQ Media projected that political media buying would reach $8.33 billion in 2020. This projection was made before Michael Bloomberg became a Democratic presidential candidate and spent over $500 million in his failed attempt to win the nomination. Additionally, since the original projection was made, the COVID-19 pandemic hit, requiring politicians to revise their media buying strategies because planned rallies and fundraising events had to be cancelled.

Since the last blog post, a few items have happened which will impact the 2020 presidential and other elections.

- Joe Biden won all the primaries and caucuses held on June 2 and June 9. As a result, he has secured the necessary number (1,991) of delegates to win the nomination during the August Democratic National Convention.

- Donald Trump has asked that the Republican National Convention be moved out of North Carolina after its Democratic governor, Roy Cooper, was hesitant to relax social distancing rules for the planned Charlotte venue. As of June 15, Jacksonville, Florida has replaced Charlotte, although there are still debates being waged on whether social distancing will limit the number of real-time attendees.

- Polls released during the weeks of June 8 and June 15 show that Biden’s lead is widening nationwide and in key battleground states. Trump’s tough “law and order” stance during the George Floyd protests around the country did not sit well many Americans.

- The National Bureau of Economic Research officially announced that the U.S. entered into a recession in February 2020, stating it was “so steep” that the announcement came earlier than normal.

- The positive May jobs report may have been incorrect due to a “misclassification error.” The Bureau of Labor Statistics admitted that its monthly household survey had mistakenly counted 4.9 million people as employed in April and May, although they were unemployed. Thus, the April unemployment rate was actually 19.5%, not 14.7%, and May was 16.1%.

- Coronavirus cases have been increasing in 23 states in June, particularly in Arizona, Texas and California. Florida closed some businesses and beaches due to the unexpected increase only a week after giving permission for them to open.

- Additional Democratic VP candidates have surfaced. Atlanta mayor, Keisha Lance Bottoms improved her national name recognition with her actions during the George Floyd protests in her city. Former national security advisor Susan Rice have also been mentioned.

- Trump to hold his first rally since March on June 20 in Tulsa, Oklahoma, but it is not without controversy. Given the recent rash of protests, many individuals and groups were shocked that he chose Tulsa, home to the 1921 massacre of black business people. He was forced to move the date from June 19 to June 20, after it was determined that the original date coincided with Juneteenth, the day that marks the end of slavery.

Analysis of Other Races

It should be noted that some issues impacting the presidential race discussed in the previous blog have relevance in other races as well, particularly COVID-19 and the economy. If an incumbent senator, governor, or house candidate is in a state severely impacted by the virus and unemployment, their chances of retaining the seat are hindered. The issues of mail-in ballots and voter suppression could also affect how many people vote in various states. Many pundits are currently predicting high turnout in select states that have been adversely affected by the two issues referenced above, but which could be mired in chaos during the November election as tabulated results will be delayed due to the voting process. For example, the Georgia primary in June was considered chaotic due to the closure of many voting venues in low income neighborhoods and the placement of new machines that poll workers didn’t know how to use.

Senate

After the White House, the most prized possession of the 2020 elections is control of the Senate. Polls suggest that a majority of Americans were frustrated that Senate Republicans voted down numerous measures during the impeachment trial, like interviewing new witnesses. The Republicans want to retain control of the Senate in order to push their conservative agenda, particularly relating to the appointment of federal judges, including too many that the American Bar Association deemed as “not qualified” due to the lack of trial experience. The Democrats want to gain control of the Senate to help push through more than 300 bipartisan and progressive bills that the House passed during the past two years, but which have been tabled by the current Senate Majority Leader, Mitch McConnell.

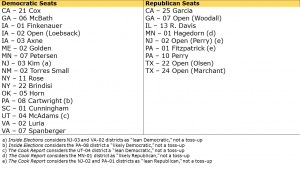

There are 35 seats up for grabs during the 2020 election – 23 Republican / 12 Democratic. The current ratio is 53 Republicans and 47 Democrats (Independents, like Bernie Sanders tend to vote with Democrats). Democrats take control if they win the White House and capture three seats, or four seats if Trump retains the presidency. Almost half (11) of the Republican seats are considered safe (AK, AR, ID, LA, MS, NE, OK, SD, TN, WV, WY) and two-thirds (8) of the Democratic seats (DE, IL, MA, NH, NJ, OR, RI, VA). That leaves 16 seats that will generate the most political media buying.

Two of the four remaining Democratic seats are considered “likely” Democratic – an open seat in New Mexico and Smith in Oregon, two states in which Biden is expected to gain the electoral votes. Unfortunately, there haven’t been any polls since COVID-19 hit to determine sentiment in those two states. The Republicans are most likely to target Peters in Michigan and Jones in Alabama. There have been no 2020 polls in Michigan to ascertain Peters’ strength, while Jones is behind three different Alabama Republican primary candidates in February polls. If the Jones seat switches back to Republican, the Democrats would have to win four current Republican seats if Biden is elected, five seats if Trump remains the president. As stated a few weeks ago, the 2018 blue wave that helped Democrats in the House was not emulated in Senate races, where Republicans won three of four toss-ups, so it’s an uphill battle.

There are only four toss-up seats, all currently held by Republicans – McSally (AZ), Gardner (CO), Collins (ME) and Tillis (NC). Recent polls have the Democratic candidates increasing leads in Arizona (Kelly) and Colorado (Hickenlooper), in some instances by double digit rates. In Maine, Collins held a solid double-digit lead in 2019 polls, but the Democratic candidate (Gideon) has a single-digit lead in the three polls taken in 2020. North Carolina remains tight, with a late May poll favoring Tillis, while an early June poll favors the Democratic candidate (Cunningham).

Since the margin of error is so thin, the Democrats will target five additional Republican seats currently categorized at “lean Republican”: Perdue (GA), Loeffler (GA), Ernst (IA), Open (KS), and Daniels (MT). In Montana, the dynamics changed when popular Democratic governor Bullock dropped out of the presidential race and entered the Senate race. In a May poll, Bullock took a seven-point lead over Daniels after being even in March when he first entered the race. The Kansas open seat candidates won’t be chosen until August 4, although Kobach and Marshall are the leading candidates to face presumptive Democratic candidate Bollier. In April-to-June polls, Bollier leads Kobach, but trails Marshall. In Iowa, the first poll taken in June shows that Democratic challenger Greenfield has opened a lead on Ernst, some of which has been attributed to the more than $60 million spent on TV and radio leading up to the June primaries, double what was spent in four other states combined that were also holding June Senate primaries.

Georgia has two Senate elections in 2020 after Isakson resigned due to his health in late 2019 and the governor appointed Loeffler until the special election is held in November. By Georgia law, there is no primary, so all candidates will be listed on the ballot in November. Loeffler is being challenged on the Republican side by a Georgia House Representative Collins, whom Trump supports. On the Democratic side, three candidates will vie for the nomination – Lieberman, Tarver and Warnock. In a mid-May poll, Loeffler trailed all three Democratic candidates while Collins beat Tarver, was even with Lieberman and trailed Warnock. If none of the five major candidates receives at least 50.1% of the vote in November, a runoff with the top two candidates will occur in January. Some party officials are asking two of the three Democratic candidates to drop out so that the Democratic votes won’t be split, as there is concern that both Republican candidates could reach the January runoff. Meanwhile, Perdue’s reelection bid is on hold as he was unable to win 50.1% of the vote in the June 9 primary, and thus a runoff is scheduled for August. His presumed Democratic opponent (Ossoff) led in a June poll, after trailing in May, so some might consider this a “toss-up,” rather than “lean Republican.”

As to “likely Republican” candidates, there has been a major shift since February, with two “safe” seats becoming more competitive – McConnell in Kentucky and Graham in South Carolina. Cornyn in Texas has been categorized as “likely” since the beginning of the year. Many believe that McConnell has curried enough political favors in Kentucky over the years that he’ll be able to retain his seat, and subsequently the powerful Speaker of the House position. However, his presumptive Democratic opponent (McGrath) lead in a June poll after trailing in February and throughout 2019. Meanwhile, Graham’s double-digit lead in February has evaporated and his Democratic opponent (Harrison) pulled even in a late May poll. Some wonder why Cornyn is included in this category because he had double-digit leads in March and May polls over two potential Democratic opponents (Hegar and West).

Five months is a long time in Senate races. FiveThirtyEight did an exhaustive analysis of Senate polls during the last eleven elections dating back to 1998. Although they appear to be more accurate than state-level presidential polls, there is a large margin of error – in some instances up to five points. That is, a Democratic candidate could have a two-point lead in the polls but lose the election by three points, which would fall within that statistical parameter of +/-5%. A better indicator of which candidate will carry a state won’t be determined until the October polls are conducted. Because of this uncertainty, both political parties will invest heavily in the sixteen states discussed here. It becomes an issue if any of these states are presidential battleground states, as advertising and marketing inventory will become tight. For example, Arizona and North Carolina are toss-up states in both the presidential and senate races, so TV and radio ad inventory in markets like Charlotte and Phoenix will be in great demand.

House of Representatives

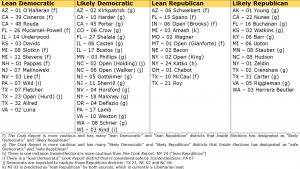

The magic number is 218 – number of seats required to have control of the lower house of Congress. Currently, Democrats control 233 seats, the Republicans 201, with one Libertarian. In order for Republicans to regain control of the House, they need to retain all their seats and flip 17 Democratic seats – a very tall order given the current prognostications of The Cook Report and Inside Elections. When Democratic safe, lean and likely seats are combined, both sources already have the Democrats keeping control of the House regardless of the toss-up/tilt results – 220 seats and 223 seats, respectively, including three Republican districts that are projected to switch to the Democratic party.

There are 26 House races that are considered “toss-up” races (see table below). Of these, 17 are currently Democratic districts, nine are Republican districts. Almost none are in the six toss-up presidential election states, with the exception of three in Pennsylvania, thus media buying might not be much of an issue for House candidates. If the list expands to include the presidential lean/likely states, more House candidates could find TV and radio inventory issues, including Georgia, Iowa, Maine, Minnesota and Texas.

The House races also differ from presidential, senate and gubernatorial races, because candidates only need to purchase the DMA(s) in which their districts are located versus needing to buy inventory in every state DMA. For example, the PA-01 candidates only need to purchase local media in Philadelphia, the PA-08 candidates in Wilkes-Barre and the PA-10 candidates in Harrisburg. COVID-19 is probably less an issue, since statewide initiatives determined if and when social distancing and stay-at-home edicts were enforced. The economic health of select DMAs and the recent reactions by the incumbent to the race protests would be better indicators as to whether the party can hold onto the seat. There haven’t been many polls taken for House seats since the COVID-19 pandemic. Of the polls taken since March, both parties can tout some minor victories. For example, the Democrats are gaining ground in Iowa, while the Republicans have rebounded in Georgia. The expected outcome is that one party will gain approximately five seats (e.g., Democrats will rise to 238 seats OR Republicans up to 206 seats).

The number of other House battleground districts, designated as “lean” or “likely,” is a matter of debate. The Cook Report lists 60 districts that would meet these criteria, Inside Elections only 33 districts. The districts that are the most important are those in the six presidential toss-up states, as these House elections could drive voters to the poll in Arizona, Florida, Michigan, North Carolina, Pennsylvania, Wisconsin and Nebraska’s 2nd district. Many other presidential battleground states also have contentious House races that could engage voters in places like Houston, Atlanta, Denver and Bangor.

Toss-Up Races

Lean/Likely Candidates

Governor

There are 11 gubernatorial races, not 13 as stated a few weeks ago. More than half are either safe Democrat or Republican – DE, IN, ND, UT, WA and WV. Of the remaining five races, two are likely Republican: MO and VT, while NH is a lean Democratic and NC a lean Republican. The latter two are the only contentious gubernatorial races that are occurring in states that have are among the 16 presidential battleground states.

Only one gubernatorial race is true toss-up – Montana. Current governor Bullock is not allowed to seek another term and is running for the Senate instead. Primaries were held on June 2, with Gianforte, a House member, winning the Republican nod and Cooney, the current lieutenant governor, winning the Democratic nod. No polls have been taken yet to determine if one of the candidates has a slight edge.

Ballot Initiatives & Referendums

Over the last two weeks, an additional nine referendums have been certified to bring the total to 90. On June 15, 2016, there were 106 measures and 116 on the same date in 2012, years in which the final totals were 162 and 188 referendums, respectively. Based on previous trends, 2020 will most likely have the lowest number of ballot initiatives in more than decade, with less than 150 referendums.

Many referendums are not considered “vote drivers” – issues that lead to high engagement among voters. Taxes, bonds, education and voting procedures make up the majority of initiatives, which are not vote drivers. Three issues in 2020 are expected to increase voter engagement: a) marijuana (MS, NJ, SD); b) gambling (MD, SD) and c) healthcare/abortion (AR, CO, LA, ME, MO, OK). Most states with vote drivers won’t make a difference, as they are primarily in safe Republican seats, with CO and ME the exceptions.

State & Local Races

Democrats are hoping to flip eight state chambers in 2020: AZ, FL, IA, MI, MN, NC, PA and TX – all presidential battleground states, including four of the six toss-up states. These could prove to be better “vote drivers” than referendums. The Democrats are hopeful that the blue wave of 2018, in which they flipped six state chambers, will continue in 2020. Meanwhile, Republicans have targeted seven states that are currently Democratic controlled: CT, CO, ME, NH, NM, NV and NY, of which four are battleground states, but no toss-ups.

Meanwhile, there are 212 mayoral races to be decided in November, primarily in CA, FL and TX. There are 59 contests in cities with over 100,000 population, but only two in cities with more than 1 million people – Phoenix and San Diego, of which Phoenix is in a presidential toss-up state and might be a vote driver. While there are contentious races in other large cities, like Baltimore, most are not in states that are considered presidential battleground states. Other than Phoenix, 21 other cities with over 100,000 population are in battleground states, of which 14 are in Texas – Corpus Christi, Lubbock, Garland, Killeen, Denton, Waco, Carrolton, Round Rock, Abilene, Pearland, Odessa, Sugar Land, Wichita Falls and Allen. The seven other cities include: Winston Salem (NC), Hollywood (FL), Coral Springs (FL), Ann Arbor (MI), Palm Bay (FL), High Point (NC), and Pompano Beach (FL).

Revised 2020 Political Media Buying Projection

In August 2019, PQ Media projected that political media buying would reach $8.33 billion in 2020. This projection was made before Michael Bloomberg became a Democratic presidential candidate and spent over $500 million in his failed attempt to win the nomination. Additionally, since the original projection was made, the COVID-19 pandemic hit, requiring politicians to revise their media buying strategies because planned rallies and fundraising events had to be cancelled. That said, the April-to-August time frame is often the slowest of the political media buying cycle. Primary spending decelerates rapidly as the frontrunners are identified and both parties wait until after their conventions to start reaching out to target audiences. There was a slight anomaly in 2020 as some primaries for Senate and House seats were pushed back due to COVID-19, but in many instances the delayed primaries were not very contested, thus additional SuperPac monies were not a necessity to get favorites elected.

However, social distancing and stay-at-home edicts led to an increase in media consumption. Television viewing surged, particularly on streaming services. Audio listenership jumped, especially on podcasts. Print media readership leapt, although most of the gains were attributed to the digital extensions of newspapers and magazines. Online and mobile usage skyrocketed, some of which was driven by an increase in virtual video teleconferences, straining broadband bandwidth. Direct mail distribution and telemarketing rose to reach the stay-at-home voters. Public relations and influencer marketing took on added importance as politicians had to defend statements made about the impeachment trial, coronavirus and racial unrest. Branded promotional products, like issue-oriented face masks gained in popularity. Market research became more vital in determining the degree of importance of various issues, particularly the impeachment, COVID-19/healthcare, economy and race relations.

From a political media buying perspective, only two media platforms were adversely affected by COVID-19: out-of-home media and experiential marketing. Fewer people were driving in March and April, almost 50% below normal traffic patterns. There was also less foot traffic to many digital out-of-home venues due to closures of movie theaters, gym, salons and office buildings, among others. Experiential marketing was the hardest hit, as consumer political events were cancelled or postponed due to social distancing guidelines. For example, Trump went more than three months without holding a rally. Meanwhile, both conventions have been altered, with the Democratic convention pushed back a month and the Republican convention moved from North Carolina to Florida. Although candidates attempted to hold viral events, attendance suffered, and the lack of voter engagement was evident.

Despite spring and summer being slow political media buying months, politicians were aware of the increased media consumption and placed ads in various media platforms to reach larger audiences than normal during these months. Additionally, politicians were able to reach these larger audiences at a relatively low CPM rate, as most media operators had to drop fees because regular advertisers left in droves, particularly small local businesses and industry verticals impacted by the virus, like airlines, hotels and entertainment.

Revised Total Media Buying by Platforms

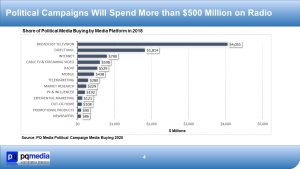

As a result of the issues outlined in this blog and the previous one on the presidential race, PQ Media has revised its 2020 political media buying projection up to $9.33 billion, representing a 28.8% increase over 2016 spending. Spending on broadcast television (local and network) will exceed $4 billion for the first time ever ($4.05B), driven by presidential candidates using network television much more than in past campaigns, such as Bloomberg and Trump both spending over $5 million each airing ads during the Super Bowl. Direct mail will rank second in spending, reaching $1.81 billion, fueled by an increase in local politicians using the medium during the COVID-19 pandemic in lieu of holding rallies. Digital media – online and mobile media – will represent 13.2% of political media buying ($1.28 billion), spurred by social media and digital video advertising. Mobile media will exhibit the largest gain compared with the 2016 elections, up 329.4%, as smartphone penetration has almost doubled since the last presidential election. Other media platforms registering growth rates over 50% include public relations & influencer marketing; internet media; promotional products, such as MAGA hats and market research. Two media platforms will post declines in 2020 compared with the 2016 elections – newspapers and experiential marketing, the latter driven by fewer rallies and fundraising events due to social distancing and stay-at-home measures.

Where Does Radio Fit?

Since this blog is being written for the Radio Advertising Bureau and the question is always “where does radio fit?” Audio advertising is expected to rise 29.3% (compared with 2016) to $529 million, with digital platforms fueling the growth, such as podcasts. Historically, radio benefits from multiple contentious races in select states, as campaigns turn to audio when television inventory becomes tight. Additionally, multicultural audiences over-index in audio consumption, thus many candidates will attempt to reach African American and Hispanic voters using this medium, particularly in toss-up states.

(Click here to download this and additional charts.)

Total Media Buying by Campaign Categories

Presidential campaigns are the largest of the six campaign categories at $3.17 billion, representing a 41.6% increase over 2016 spending, spurred by Bloomberg’s self-financed campaign during the primaries. Some Senate campaigns are expected to break records, such as the Kentucky and South Carolina battles to replace among the most vocal Republicans supporters of Trump, McConnell and Graham, which will drive a 26.8% increase in spending compared with 2016, reaching $2.41 billion. Meanwhile, the gubernatorial and referendum categories will post the slowest growth, compared with the 2016 elections due to fewer contested races and initiatives being registered, respectively.

Key DMAs

In which markets will media operators exhibit the strongest growth in political media buying? To answer that question, one must examine the battleground states for the various campaign categories. For example, both the presidential election and Senate seat in North Carolina are considered toss-ups, in addition to select markets that have contentious House and/or local elections. Based on PQ Media analysis, the following 20 DMAs are expected to have major advertising and marketing inventory issues because multiple candidates will be buying time or space. Rankings are based on the closeness of races (e.g., toss-ups vs. lean/likely) and the type of campaign categories expected to spend more than others (e.g., presidential vs. local).

Charlotte-Gastonia-Rock-Hill (NC/SC) is expected to post the greatest growth rate due to a high number of contentious races. Four other North Carolina markets rank in the top six in political media buying (PMB) growth – Raleigh-Durham-Fayetteville, Greensboro-Winston Salem-High Point, Greenville (NC)-New Bern-Washington and Greenville (SC)-Spartanburg-Asheville. Houston-Galveston is the largest market, ranked eighth by Nielsen’s 2020 TV DMA rank. Other large markets include Atlanta, Phoenix, Detroit and Denver-Boulder. There are 12 small markets (ranked 100th or lower by Nielsen), including Presque Island (ME) and Great Falls (MT).

Top 25 DMAs with Multiple Contentious Races