Author: Annette Malave, SVP/Insights, RAB

When considering advertising categories, there are some that have experienced numerous changes because of and due to the pandemic. Some of those changes were limited to the pandemic while other categories have undergone drastic changes influenced by external issues beyond the pandemic.

The auto industry has been on a roller coaster ride with inventory limitations, excesses and now with tariff concerns looming over their proverbial heads. As the tariff concerns grew greater, consumers have hit the marketplace with the hopes of buying a new vehicle at a lower rate. However, this surge in pre-tariff buying may be creating an inventory challenge for auto dealers. Understanding what auto buyers want and how they like to shop always matters, most especially now.

Prior to the concern of tariffs, Cox Automotive queried consumers in late 2024 to understand their purchase journey and compare it to years prior. Four in 10 consumers agreed that their buying experience was better than it had been in previous years. This satisfaction level may be higher due to higher prep and research levels. Consumers spent over 14 hours researching and shopping online, speaking with other and visiting dealerships – 48 minutes greater than 2023.

Even with the research and time spent, most consumers still prefer to shop in person. Fifty-one percent of new and used auto buyers did their auto transactions in person. (The auto buying experience is important to consumers so the experience at the dealer location should reflect that. Consumers want to know that the experience will be a positive one – an important aspect to note when reaching those in the market to buy a vehicle.) However, those who prefer online transactions are more apt to learn about incentives, estimated payment and F&I qualifications online versus in person.

Overall, the Cox Automotive survey found that consumer satisfaction levels with dealerships were high in 2024, 73% – but down from the 2020 high point of 77%.

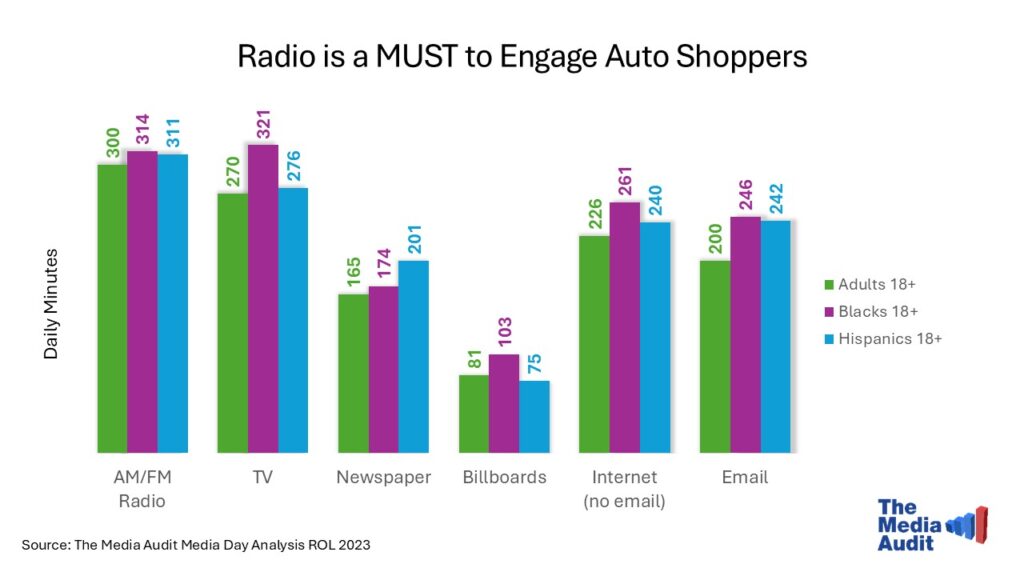

Despite the high satisfaction levels existing among auto-buying consumers, the possibility of a shift in those perspectives can change quickly. The industry experienced that during the pandemic. Dealers will need to advertise on a medium that is nimble and can quickly adapt to changes in messaging. No local medium does that better than broadcast radio. It is also the medium that connects with consumers who are in the market for a new vehicle. Heavy radio listeners (three or more hours per day) spend more time listening to radio than using any other media option. According to The Media Audit. Heavy radio listeners who plan to purchase a vehicle (car/van/truck/SUV or crossover) spend 24% of their total daily minutes listening to radio.

Broadcast radio not only reaches consumers who are in the market for a vehicle, but AM/FM radio also dominates in-car ad-supported audio and accounts for 86% of audio share, per Edison Research’s “Share of Ear” report.

When connecting with radio listeners, auto dealers should address consumer concerns on tariffs. According to an MRI-Simmons 2025 Q2 Trending Topics survey, 76% of radio listeners are concerned that tariffs will increase their everyday purchases. Including information on inventory levels, etc. will help auto buyers know where to go for their vehicle purchases and what to expect.